9 Wealth Management Software Tools

How much has your wealth appreciated? How’s your cash flow looking? What’s your portfolio allocation? How do you manage expenses? Am I spending too much?

These questions become more challenging as your net worth grows and diversification sets in.

I commend you if you’ve kept your money in <5 accounts.

It seems most though, have collected brokerage accounts over the years in addition to alternative investments and multiple credit cards.

I’ve collected 9 software tools that can help manage your wealth. I’ve only used a handful, which I’ll note with an * asterisk.

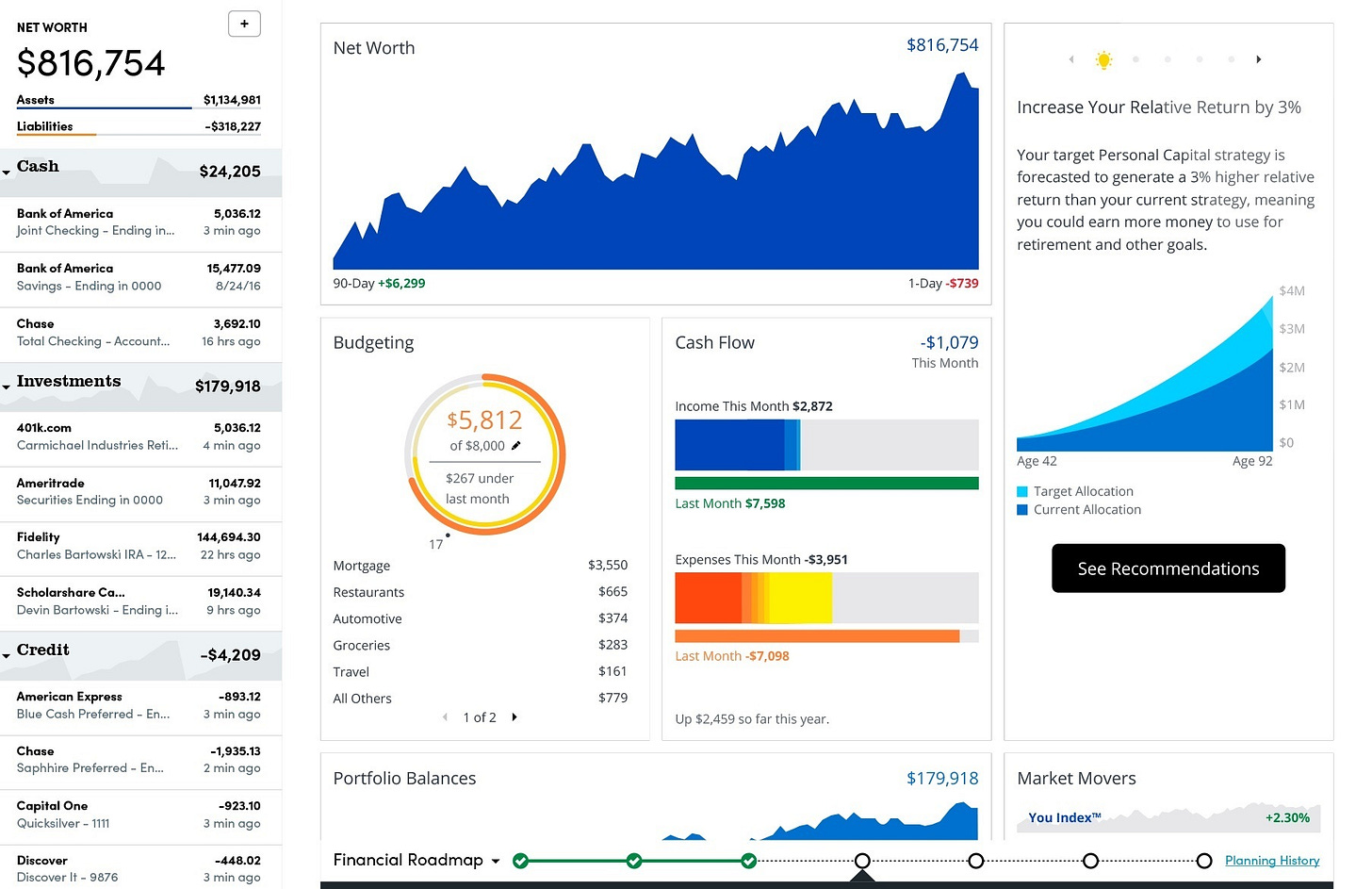

Empower (Personal Capital)*

I use Empower for the following reasons:

It’s an attempt to understand cash flow. It’s not perfect but can roughly show

Allows me to see performance across all assets fairly well. At times connections don’t work, but generally, it’s good to compare how I’ve performed against benchmarks.

There’s a neat Fee Analyzer to help reduce asset costs. Swap ETFs for lower-cost equivalents. Know what the fees are wealth managers have you in.

After selling my business I played with the Retirement Analyzer a lot to understand what my current spend can be if I retired at 45.

I don’t use the budgeting portion of this app as I find it clunkier than Rocket Money (Truebill)’s app.

Kubera*

I just started using Kubera because Empower (Personal Capital)’s connections aren’t the best so I wanted to try Kubera.

It’s beautifully designed and costs $150/year. The negatives though are the functionality is limited. No cash flow analysis, or expense tracking. Just high-level net worth and portfolio allocation tracking.

QuickBooks*

Good ol’ QuickBooks. I’ve found this tool helps me with cash flow.

I use the Self-Employed plan for $7.50/mo.

You can completely understand cash flow. All dividends, other income, and expenses to pass to see monthly and create reports for your accountant. It takes time each month to correctly categorize expenses, but using their automation, time spent is reduced each month.

If you’re doing consulting on the side, you can attach receipts in this plan too and separate business/personal expenses.

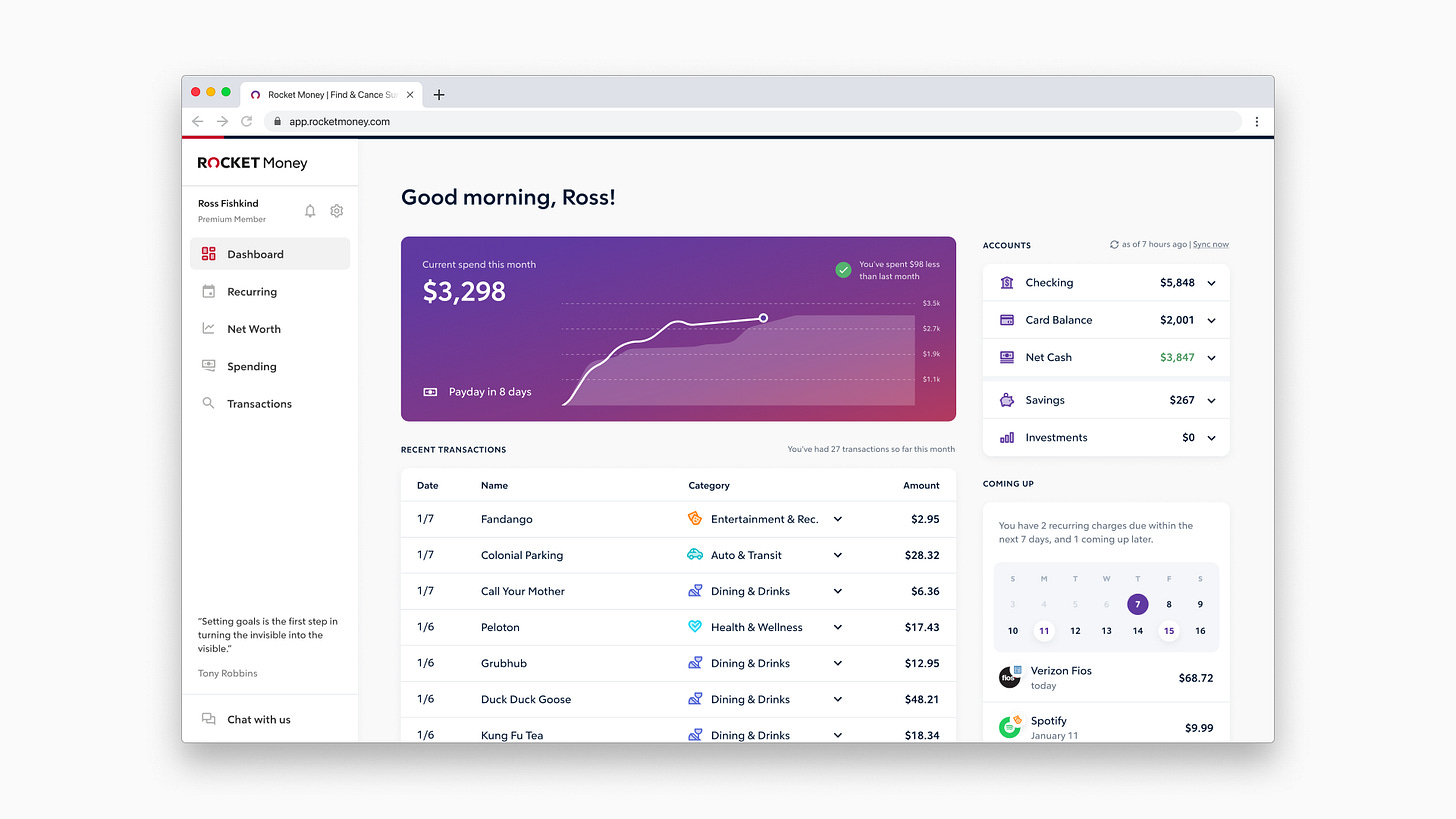

Rocket Money (Truebill)*

I enjoy Rocket Money’s app for budgeting. The mobile app is quick and brings transparency to monthly spending.

I’ve tried setting up their Net Worth tracker, but it doesn’t understand many investment accounts. I’d pass on this feature. They also have a feature that can help reduce monthly subscriptions. I gave it a whirl and didn’t help.

They just released a web app too, which everyone else has and makes it easier to mass categorize expenses.

The design is easy to use and pleasant to use throughout the month and costs $3-$12/month.

Compound

Compound is a wealth management group with a clean-looking software solution attached. It appears the fees are assets under management (AUM) based, ranging from $3,000 to $50,000/yr.

Compound targets users involved in startups with options to manage.

There’s the ability to view net worth, create interactive retirement plans, upload estate documents, and break down portfolio allocation.

You can play with their demo account here.

Copilot

Copilot is a Rocket Money competitor with a focus on budget/spending management.

You can also add investment accounts to watch net worth. I’m skeptical of that functionality with the issues I’ve had with Rocket Money.

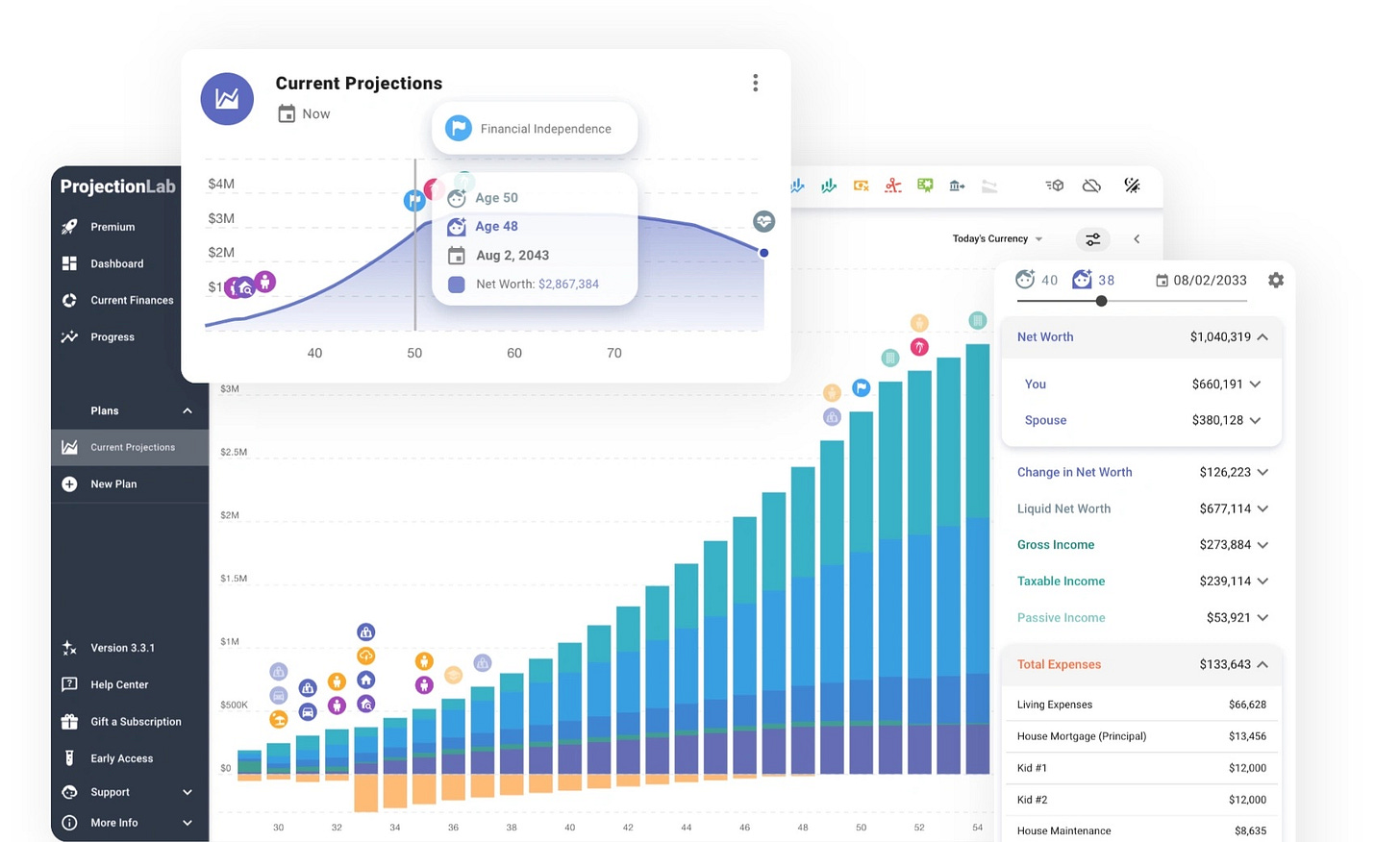

ProjectionLab

If you’re looking for more more of planning based software, ProjectionLab may be your best bet. You can create future milestones and simulate retirement, expenses, and withdrawals.

You don’t link actual accounts to ProjectionLab (if security is a major factor), so initial setup may take some time. Pricing plans are $0-65/mo.

It’s also been neat watching Kyle openly build ProjectionLab into what it is today.

Portfolio Visualizer*

I’ve liked using Portfolio Visualizer when understanding how portfolio allocations affect returns. There are many factors you can dial in to do Monte Carlo simulations, portfolio modeling, and underlying risk to over-allocating asset classes.

Essentially, if you want to get in the weeds on your portfolio (using historical data), it can help predict future returns.

I use the “Backtest Portfolio Asset Allocation” and “Monte Carlo Simulation” every few months. Here are a lot of other examples.

There’s a free and paid plan if you want to save portfolios for future use. Paid plans start at $19/mo (billed annually).

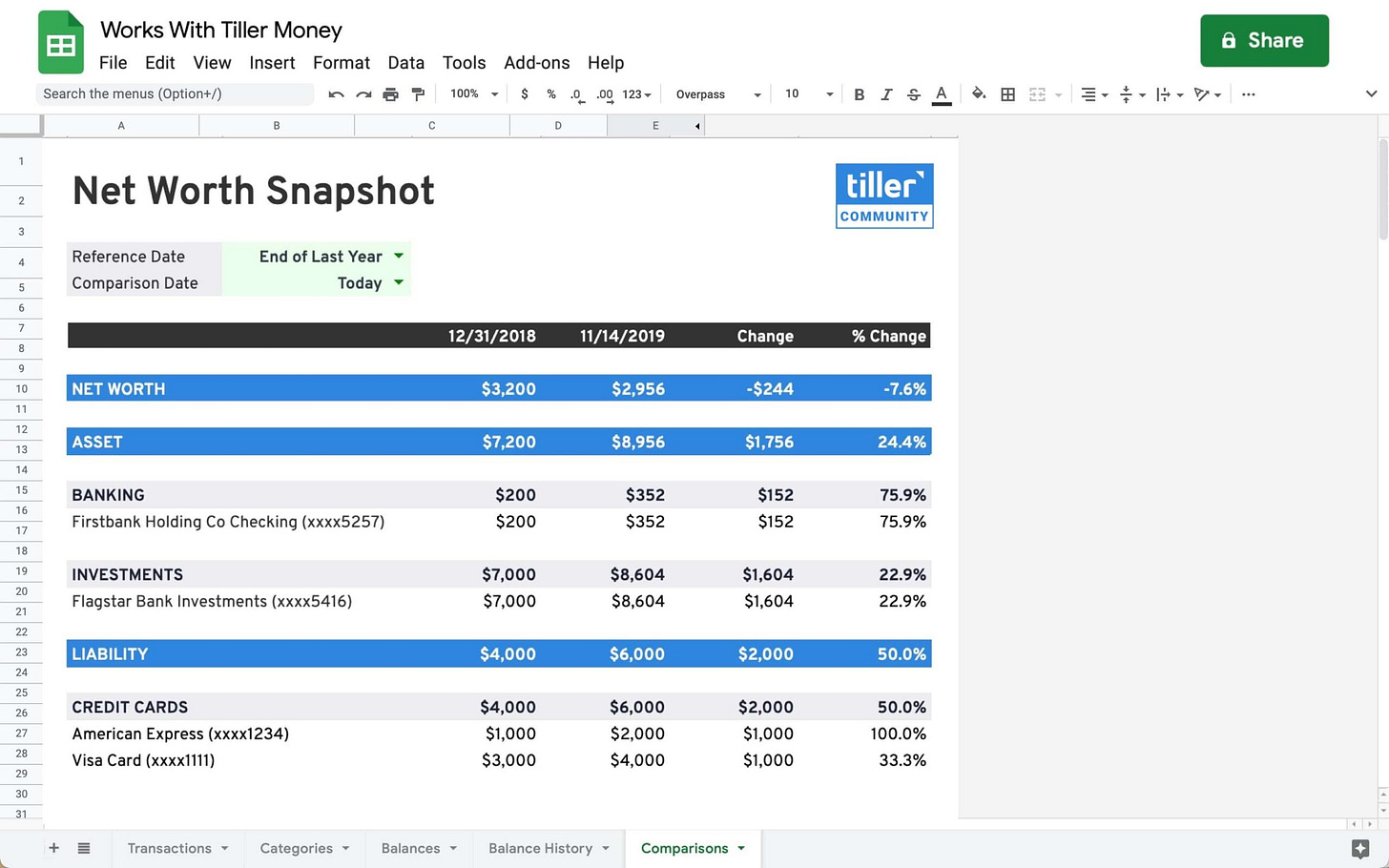

Tiller

Tiller is unique in that it connects your banking/brokerage accounts to Google Sheets or Excel. I don’t believe there’s a security benefit of downloading your financial data to Sheets vs using a web-based dashboard since you still have to connect your accounts via Plaid.

Regardless, Your income and expenses download into templated sheets. You can edit categories from the transactions to adjust and set up automatic rules for future transactions.

What’s nice to see is the month-by-month net-worth tracker to track overtime. Most apps just show a line chart, instead of the breakdown.

The negative here is no dedicated mobile app. I guess you could view Google Sheets on your phone, but not ideal.