13 of the Best Tweets About Wealth

Tweets that make you think

The problem with this statement is when you reach your goals, you set new ones.

There are diminishing returns above a point where your annual expenses are more than covered. But can you be satisfied when you hit your goal? Or does the rule of 2x more “feel about right” apply?

I’m sure whatever you have now would be shocking to a version of you 10 years ago. Are you satisfied now?

Jason Lemkin is one of, if not the best, SaaS gurus.

This applies to personal finance, too. A more significant gap between income and spend is freeing.

Who knew a private chef and eating well for a family of 4 was attainable (post-windfall)?

Marshall spends $260/week in labor and $250/week in groceries. That’s $2,040/mo. Not bad, plus lots of time saved.

Excellent thread on improving fundamental health aspects.

You can dig as deep as you want down the longevity rabbit hole, but getting 80% of the way there is a no-brainer: food, exercise, and preventative testing.

You have money and (maybe) more time now.

No reason anymore to be out of shape.

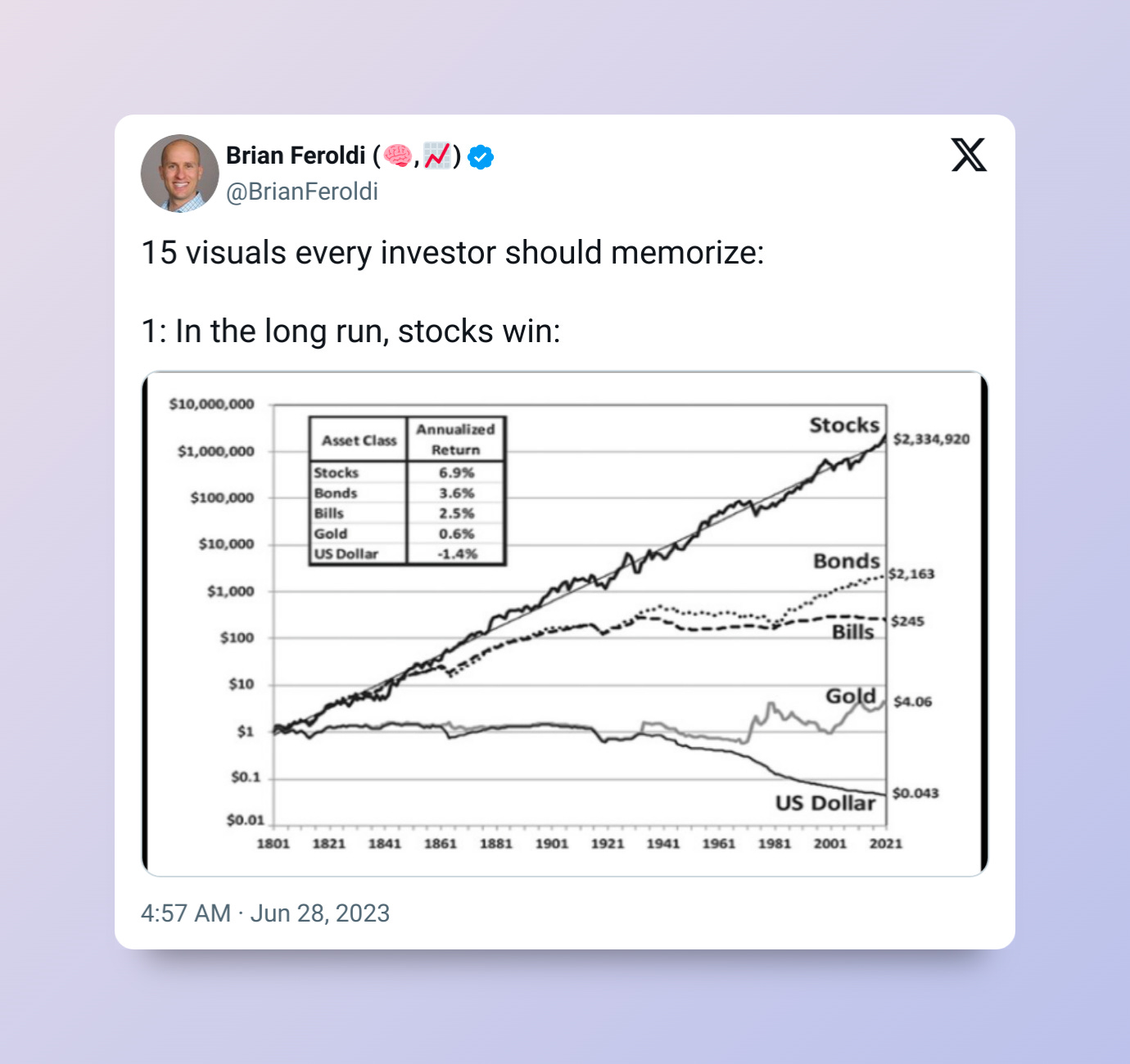

Chamath had a great tweet about this, “Psychology ultimately taxes our returns more than ANYTHING else.” So true.

We’re our worst enemy when buying and holding slow-growth, long-term investments.

“Slow down and embrace the sweetness.”

Usually, these posts are child-driven, but they apply to everyone post-exit. Enjoy the present more, the special memories that are being created.

This has taken me ~2 years to get better at, but “creating memories” is my goal.

After selling your company - Get rid of everything you don’t want to do (probably should have before selling too).

Hate doing laundry? Hire someone to do it weekly. Cooking take too long? Have a chef drop off food. Tired of booking appointments or handling house maintenance? Hire a part-time assistant.

I’m careful with this, as it’s easy to outsource everything and feel useless.

My current outsourced list: weekly landscaping, monthly home cleaning, weekly pool maintenance.

I find it challenging to go from a previous identity of working hard and growing a company for tomorrow to feeling 100% fulfilled and enjoying the present.

10 years of focusing on tomorrow and the next day takes time to unwind.

If I could rewind time, I would have planned what retirement would be like sooner than later.

This x 1000.

Having moved to Los Angeles recently, you’d think everyone was a high roller. Driving G-Wagons, shopping at Erewhon, Instagraming from fancy vacations.

It shouldn’t be a surprise that some of my best, well-to-do friends wouldn’t be able to picked from a lineup of “this guy has money”.

Great read about how retiring early delivers fulfillment sooner. We delay gratification too long.

This last decade’s use of social media created a larger gap between the “look” of wealth and people with wealth. Be careful.

A lot of this is fluff. Pet cloning? Art insurance? As assistant? Who cares.

I’m no billionaire, but here are a few privileged things wealthy millionaires have access to:

High-yielding, tax-advantaged investments that have minimum investment amounts

Concierge medicine with doctors on call

Free tickets to events, dinners, concerts, sporting games

Tax advice/strategies to reduce tax liability

(Add any I’m missing in the comments!)

I couldn’t agree more.

Lifestyle creep is real.

Being exposed to new things you’ve never seen before is real, and it makes you wonder if you had 2x more.